Original source: Research & Perspective

About Kirstein

Kirstein is a European strategy consultancy, with a singular focus on delivering action-oriented advice to the global asset and wealth management industry. For more than 28 years, Kirstein has advised the largest asset management organizations globally and a variety of specialist asset managers across all major asset classes. Fueled by its proprietary research infrastructure and data from interactions with close to 500 European asset owners, Kirstein is positioned today as a premier provider of sales, marketing, and strategy advisory in Europe.

About MacKay Shields

As an institutionally focused asset manager, MacKay Shields specializes in fixed income credit and less efficient segments of global equity markets where proprietary research can generate attractive client-oriented outcomes. We manage 162 billion USD in AUM1 across independent portfolio management teams: Global Credit, Global Fixed Income, MacKay Municipal ManagersTM, High Yield, Convertibles, and Fundamental Equity.

Introduction

In recent years, sustainable investing—which integrates environmental, social, and governance (ESG) concerns into investment decisions—has moved from a hot trend to a mainstream investment approach. Once associated primarily with equity strategies, consideration of ESG factors is now widespread in fixed income portfolios. Partly in response, commercial data vendors and regulators have created a host of ratings and labels. This prompted MacKay Shields to investigate with Kirstein what institutional investors want from their fixed income managers and whether the market is moving toward a homogenous approach to sustainable investing.

In a questionnaire and interviews with senior executives at 66 institutional investors in Europe and the US, the survey explored why investors do or do not invest in sustainable fixed income strategies, and the challenges and opportunities they see in practice. We thank the survey participants for engaging with us. In addition, the survey investigates the impact of recent initiatives by regulators and commercial firms to standardize sustainable investing. We also looked at how investors’ ESG demands are likely to shape the asset-management industry in the future.

Key Takeaways From Kirstein’s Survey

- Sustainable investments are in high demand in institutional markets, particularly in Europe.

- This is driven by public and client pressure, as well as investor belief that ESG considerations can mitigate risk and provide opportunities to generate alpha, and a way to make the world better.

- Investors are not ready to rely solely on ratings and labels provided by regulators and commercial rating firms when selecting third-party managers.

- They are also not looking for a common denominator when selecting ESG managers. They are looking for managers that provide sustainable fixed income solutions adapted to their own needs and goals.

- The market has been moving from simply excluding issuers with poor ESG scores to integrated ESG strategies. While exclusion strategies can be passive index investments, integrated strategies must be active. The trend to integrated strategies may, therefore, blunt the trend to index investing.

The MacKay Shields Perspective

After the survey report, we share MacKay Shields’ perspective as a long-time manager of sustainable fixed income portfolios.

- MacKay Shields’ experience supports investors’ belief that integrating ESG factors with traditional financial factors can reduce risk and add alpha in fixed income portfolios.

- While we agree the market needs greater transparency, we are pleased investors aren’t ready to rely solely on standardized ratings and labels in sustainable investing. We believe active management can add significant value.

- We offer examples of how our teams seek to add value through proprietary ESG research integrated into credit research and portfolio construction, engagement with portfolio companies, and investing in niche, often overlooked assets that lend themselves to sustainable investing.

Widespread Strong Demand

Sustainable fixed income investments are in high demand in institutional markets, and ESG integration has grown as a method to achieve ESG goals. This stance is particularly widespread in Europe, supporting the common perception that Europe is the epicenter of ESG investing, though US investors are closing the gap.

Sustainable investments have reached more than EUR 35 trillion in assets under management globally, up from nearly EUR 23 trillion in 2016.1 In Europe, the market for sustainable investments has plateaued at EUR 12 trillion, which is mainly linked to increased regulation on sustainable assets. In the United States, the market for ESG has grown significantly in both absolute and relative terms with the share of assets in sustainable mandates almost doubling since 2014, from 17.9% to 33.2%.1

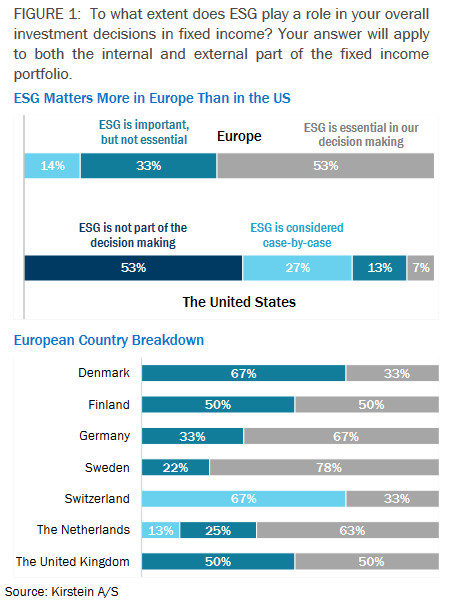

Our survey looked first at how important sustainable investing is to investors’ overall decisions in fixed income portfolios, whether managed internally or externally. In Europe, 86% of the investors we surveyed rated ESG as important or essential, and none said ESG is not part of their decision-making. Figure 1 shows responses varied somewhat by country, with Switzerland being the notable outlier: Two-thirds of the Swiss investors said they use ESG only on a case-by-case basis.

Investor opinion in the US appears to be divided. Only 20% of the US institutions surveyed find ESG important or essential to overall decisions, and 53% do not view ESG as important. Note, however, that only 23% of US institutions contacted agreed to participate in the survey; perhaps because ESG remains an evolving subject in the US (see Appendix for more information on the survey panel).

Why Invest Sustainably?

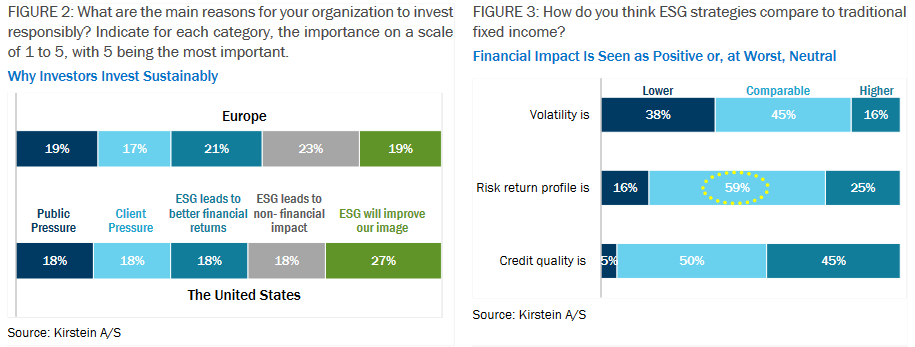

European investors appear to have greater confidence in sustainable investing. Asked about their primary reason for investing sustainably, European investors were more likely than US investors to say it would have a nonfinancial impact and lead to better financial returns. Figure 2 shows that while similar shares of US and Europe investors cited public and client pressure, a larger share of US investors (27% vs. 19% of respondents) saw it as necessary to uphold the organizations public image. In interviews, these investors called it a “necessary evil,” noting the extra reporting burden it created. Further, a fair number of mostly commercial investors in Germany and the Nordic region said fear of missing out contributes to their focus on ESG.

In interviews, we learned that in the US some firms do not seek to achieve ESG goals by investing; they integrate it at an organizational level with their philanthropy. Many of the US investors also cited a lack of stakeholder commitment and issues with ESG data quality and availability as reasons why they do not focus on sustainable investing. That said, recent flows into ESG strategies in the US suggest that stakeholder commitment is growing.

1. Global Sustainable Investment Review, 2020 (GSIR)

Investors Don’t Believe ESG Entails Financial Sacrifice

Many investors believe ESG investing could improve their financial results, or at least do no harm, shown in Figure 3. Asked to compare ESG and traditional fixed income portfolios, 83% anticipated that ESG portfolios would have comparable or lower volatility, 84% said ESG portfolios would have comparable or higher return for risk, and 45% said that credit quality would be higher in ESG portfolios.

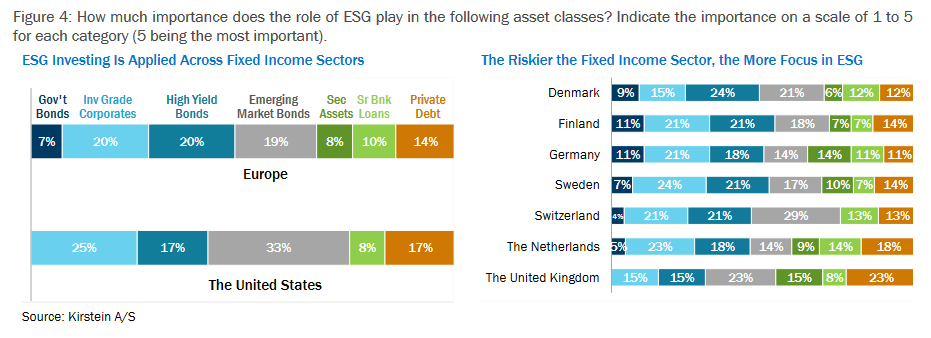

Given the belief that a thoughtful ESG approach can help mitigate downside risk, it is perhaps not surprising that European and US investors agree ESG should play a significant role in managing corporate bonds in developed markets (both investment grade and high yield) and, to a large extent, when managing emerging market debt (see Figure 4). This appears to reflect the importance of mitigating risk in more credit sensitive fixed income, where potential upside is generally limited but downside risk can be large, particularly in cases of default. Identifying potential risks is thus key to returns, and many of those are ESG risks.

Views on Ratings and Labels

ESG data sources, ratings, and rankings have proliferated in recent years, as commercial vendors have sought to profit from the growth in sustainable investing. Today, hundreds of ESG ratings and rankings exist globally; we expect the number to continue growing, despite early signs of consolidation among the leading providers. Meanwhile, regulators are issuing frameworks, standards, and labels to increase transparency. Until now, the extent to which ratings and labels drive investment decisions has not been established. Our survey provides some answers.

Investors Use ESG Ratings for Many Purposes

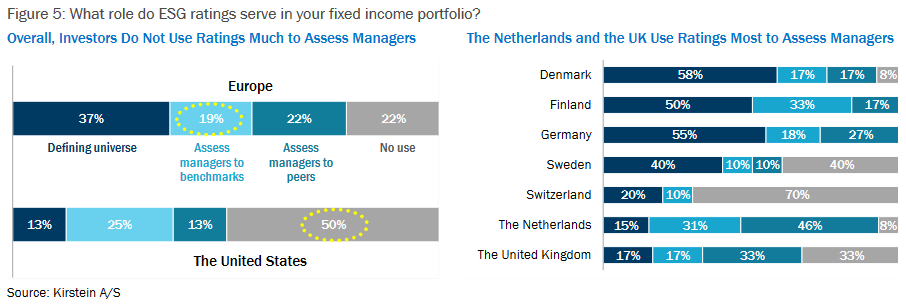

Investors are frequent users of commercially available ESG data, ratings, and rankings. Firms that provide ESG and corporate governance research, ratings, and analytics—such as Sustainalytics, MSCI, and others—have become fixtures for many investors. Figure 5 shows that all but 22% of European investors and half of US investors use ESG rating systems. The role these products play in investors’ fixed income portfolios varies widely, particularly when it comes to manager selection. In Europe, 37% of investors who responded to their use of ESG ratings mention that they use them to define investable universes. To a large extent, this is connected to the widespread use of exclusion strategies in ESG portfolios.

The key challenge for many investors globally remains the inconsistency of ESG data; fixed income investors frequently refer to this challenge. Consequently, only about 20% of the European investors who responded that they use ESG ratings mention they use them to assess managers versus benchmarks or their peers; response for the US was also low. The exceptions are investors in the Netherlands and the UK. In those countries, many investors emphasized the relative importance of ratings to assess third-party managers relative to their benchmark or relative to peers. Outside of those three countries, it seems fair to conclude that ESG ratings do not play a large role in manager selection.

Regulators’ ESG Labels Don’t Tell the Full Story (Now)

The number of ESG labels issued by local and global governments or regulators has also increased notably in recent years. Recently, the EU released its Sustainable Finance Disclosure Regulation (SFDR), which requires third-party managers to evaluate and disclose sustainability-related data and policies at entity, service, and product level. This is to prevent greenwashing and ensure a systematic, transparent, and comparable approach to sustainability is in place. Sustainable strategies recognized by the SFDR will begiven an Article 8 or Article 9 label; otherwise, they will be given an Article 6 label.

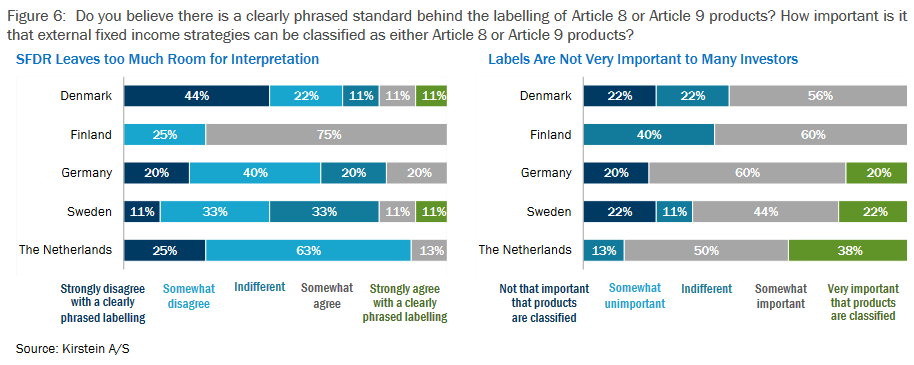

Only the minority of European investors said the standard behind Article 8 and Article 9 funds is phrased clearly enough by the regulation (see the left side of Figure 6). The Finnish investors surveyed were a notable outlier. Note: Many investors did not answer this question. In interviews, many investors said they see regulations to prevent greenwashing and provide transparency as a necessary evil (evil because it would create added administrative burdens for investors). They also said there’s a long way to go; creating useful labels for something so complex is difficult. Investors said the labels don’t tell the full story (yet).

As many investors find Article 8 and Article 9 vague, it is not surprising that only a few European investors said a label is very important to them. However, the Netherlands is the exception to the rule; 38% of those investors said it is very important to them that third-party managers products have the label.

In our discussions with investors, it seemed the most experienced ESG investors tend to be most skeptical of the SFDR labels, while less experienced ESG investors often see them as an easy way to catch up on ESG if their firm has not developed in-house expertise.

What Investors Do Look For

Integration strategies, engagement with issuers, and ESG reporting are becoming increasingly important in Europe. In the US, organizational issues dominate.

From Exclusion to Integration

In the early days of sustainable investing, excluding debt issuers that violated ESG guidelines was the most common way to ensure portfolios met the ESG guidelines that investor organizations or third-party managers established.

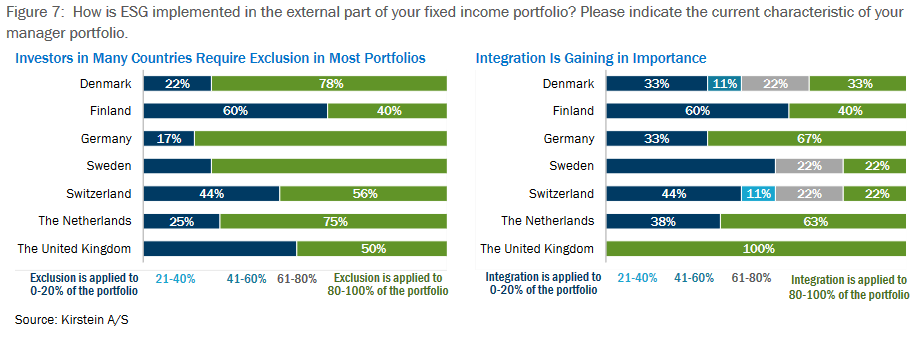

Investors in Denmark, Germany, Sweden, and the Netherlands ask managers to use exclusion strategies in the lion’s share of their portfolios, and investors in most other countries also use them for a significant share of their portfolios, shown on the left side of Figure 7. (The US is again the exception).

As a result, most third-party managers incorporate exclusion lists into their investment process, and the ability to accommodate exclusions no longer provides them with a competitive advantage. Index providers use exclusion to offer low-cost, off-the-shelf sustainable investment products.In recent years, investors have begun adding integration strategies—in which managers consider both the issuer’s ESG factors, such as carbon emissions or leadership diversity; and financial metrics, such as leverage or variability of sales and earnings—to identify the most attractive investments. Often, managers engage with issuers on ESG considerations in an effort to get them to improve, which can reduce downside risk and lead to narrower spreads, adding to investor return. The right side of Figure 7 shows that all of the UK investors, 67% of German investors, and 63% of Dutch investors now predominantly hire third-party managers with ESG integration strategies in their fixed income portfolios.

Investors in Denmark, Sweden, and Switzerland said they are converting portfolios of third-party managers from exclusion to integration. While exclusion strategies can be passive, integration strategies are inherently active. They entail active engagement aimed at influencing issuers, and actively identifying and improving companies to mitigate risk and generate positive alpha. To that end, the move toward ESG integration could potentially reverse the trend from active to passive.

In the eyes of many survey participants, what separates the great sustainability manager from the good sustainability manager is the ability to go beyond implementing ESG screens to integrating ESG factors to mitigate risk and enhance returns. In this way, integrated strategies allow investors to target both their financial and non-financial goals.

Other Manager Selection Criteria

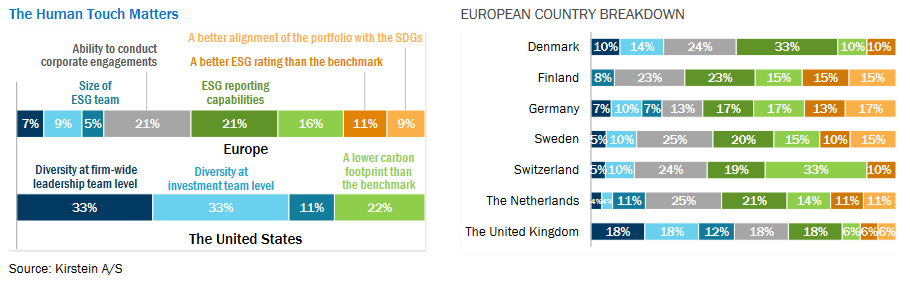

Investors also cited several other factors when asked which selection criteria are important from a sustainability perspective. European investors most often cited two ESG criteria for manager selection as important: the manager’s ability to conduct corporate engagement and its ESG reporting capabilities (see Figure 8). The ability to deliver a portfolio invested in issuers with a lower carbon footprint than the benchmark also ranks high with investors, particularly in Switzerland.

For US investors, organizational characteristics such as diversity is at the forefront when selecting managers; the size of the ESG team and ability to engage with issuers made up the balance. None of the US investors cited ESG ratings or alignment with the Sustainable Development Goals as relevant.

In sum, our survey indicates investors are not looking for a common denominator when selecting ESG managers. Rather, investors are looking for managers that can help provide ESG integrated fixed income solutions adapted to their diverse needs and goals. As US investors place leadership diversity high on the priority list, European investors tend to focus more on a manager’s ability to engage with issuers and to address goals related to climate change.

Clearly, ESG is important to fixed income investors. It seems fair to conclude from our research that going forward, sustainability is likely to be a cornerstone of fixed income portfolios, and may drive greater reliance on active managers that integrate sustainability factors and engagement with purely financial considerations.

Perspective

MACKAY SHIELDS ON ESG INVESTING

New regulations relating to ESG are now emerging or being contemplated in countries around the world. In Europe, the new regulations seek to cement ESG goals as a core component of investors’ fiduciary duty. In the US, President Biden has urged the Department of Labor to reconsider a rule finalized under the Trump government that requires only traditional financial considerations—not nontraditional concerns such as ESG goals—drive investment decisions for fiduciaries. Our research and experience suggest that ESG investing can help investors meet their financial goals, particularly if ESG research is integrated into credit research and portfolio construction.

The EU Taxonomy for ESG Investing seeks to foster measurability of results, consistency of data, and common terminology to improve transparency and prevent greenwashing—companies’ efforts to make ESG practices appear better than they are. Countries such as Canada have also issued frameworks that define green bonds to prevent greenwashing. Nonetheless, MacKay was pleased that the Kirstein survey found investors aren’t ready to rely solely on a few data points, such as commercial ratings or regulators’ labels when selecting managers, as we believe such limited information can’t possibly capture the many aspects of sustainable investing.

We believe that relying on such limited information could have adverse results including:

- It could force the homogenization of ESG portfolios when our clients’ sustainability goals vary widely. Some are linked to the sponsor’s broader corporate sustainability targets or adapted to their unique portfolio composition. Some have ambitious climate targets; others are seeking to avoid ESG laggards across industries. Some rely on exclusion, others prioritize engagement. One size doesn’t fit all.

- Second, enforced homogeneity could interfere with efforts by active managers, like ourselves, to use ESG considerations to reduce downside risk and portfolio volatility, improve portfolio return, and improve return for As a result, it could have the perverse result of making it more difficult for clients to meet their traditional financial goals as fiduciaries.

- Third, enforced homogeneity could reduce the positive impact that ESG investors can have through engagement with companies to meet ESG goals.

Here, we explain why we believe ESG considerations can help investors meet their financial and sustainability goals. Then, we discuss how we seek to do so by integrating ESG considerations into credit research, active management of diversified fixed income portfolios, and engaging with companies to improve their ESG practices while resisting greenwashing attempts.

ESG Risk Is Part of Credit Risk

The term ESG may be relatively new, but awareness of ESG risk is not. Corporate bond investors began assessing ESG risks decades before the phrase was coined, after learning the hard way that environmental, social, and governance risks can impair creditworthiness.

For example, in December 1984, a pesticide plant in Bophal, India, became the site of one of the world’s worst industrial accidents. Its accidental leak of 30 tons of a highly toxic chemical killed more than 2,200 people immediately and 15,000 over time, according to government reports. It also injured more than half a million people. Union Carbide, a US-based multinational corporation that owned 51% of the stock of the joint venture operating the plant, ended up paying $470 million to settle a lawsuit and filed for bankruptcy.

Our ESG Research Focus

Our view that environmental, social, and governance risks are often important credit risks has led MacKay Shields to integrate ESG factors into our active credit research. While we use external

ESG screening tools and rating systems to supplement our research, we also categorize investments into internal ESG risk categories to quantify these risks and incorporate ESG factors into absolute and comparative analyses of bond yields and spreads.

This work is complex and to do it effectively, we believe it needs to be at the core of our investment processes. We also firmly believe that credit analysis cannot be relegated to just analysts; you need senior investment experts who are best placed to perform diligent bottom-up credit research and address ESG-related risk factors. Senior investment experts also have long-standing relationships with companies that helps us engage with companies to improve their ESG practices in particular ways.

A Forward-Looking Approach

Unlike third-party ESG rating agencies, our teams take a forward-looking approach to sustainability issues, which allows them to invest or divest before the ESG rating changes.

One example is our Global Credit Team’s analysis on Wells Fargo, a major US bank that survived the Global Financial Crisis better than most—only to be hit in 2016 with the discovery that employes striving to meet a productivity benchmark had created millions of fraudulent savings and checking accounts on behalf of clients without their consent.

Various regulatory bodies fined the company a total of $185 million as a result of the illegal activity, and the Federal Reserve punished it by limiting its balance

sheet. Civil and criminal suits were filed, worth billions of dollars. The serious governance weaknesses within Wells Fargo harmed its customers, reputation, and growth prospects, and cascaded into financial markets. 1

Our team saw positive change after a new CEO took over the bank in October 2019. The bank adopted a simpler business model with reduced operating risk; we expected outstanding regulatory matters to be resolved. Our credit analyst’s engagement with the bank gave us visibility on these improvements underway in the fourth quarter of 2019. Only a year later, a third-party ESG data provider raised its ESG rating on the bank.

1. Companies or securities identified herein are presented for educational purposes and do not necessarily represent past or current holdings of MacKay Shields funds or strategies, and no representation is being made that the securities of such companies were or would be profitable. Please see additional disclosures on Case Studies at the end of this presentation.

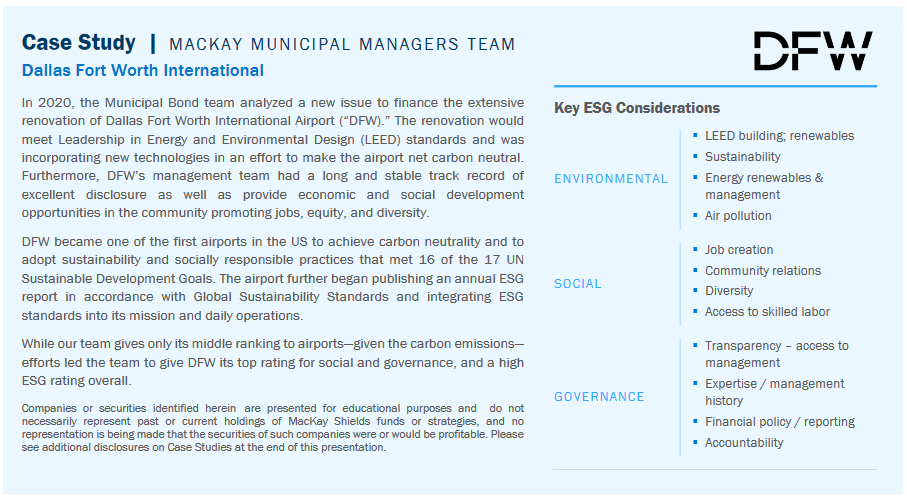

The US municipal bond market is an enormous sector within fixed income where we have identified opportunities that many investors overlook. As the primary funding source for infrastructure projects in the United States, many municipal projects are aligned with the sustainable development goals, including conservation projects for water and wastewater systems, wind farms, public education, nonprofit hospitals, public transport, and affordable housing. (See Case Study on the following page from MacKay Municipal Managers.)

The municipal bond market has about $3.8 trillion in bonds outstanding and is highly fragmented. Most issues are small, and some are too tiny to be included in a market index, yet the municipal bond index still includes approximately 56,000 issuers.1 With so many individual outstanding securities, it is not surprising that many data providers haven’t yet risen to the challenge of evaluating that universe.1

Looking ahead, we expect the Biden Administration’s policies will have a positive impact on the municipal market and create additional attractive, sustainable investment opportunities for investors. Specifically, there is positive

momentum within the bipartisan infrastructure framework that includes infrastructure spending, increasing employment opportunities, and addressing climate change.

These objectives likely coalesce in a higher volume of infrastructure-related municipal issuance that will become more recognized by impact-oriented investors for its strong ESG aspects. This should allow the asset class to continue attracting non-traditional buyers who have started discovering the asset class in recent years seeking to diversify their portfolios and generate a yield pickup over their traditional fixed income allocation.

1. Source: US Federal Reserve Z.1 Statistical Release as of Q4 2020.

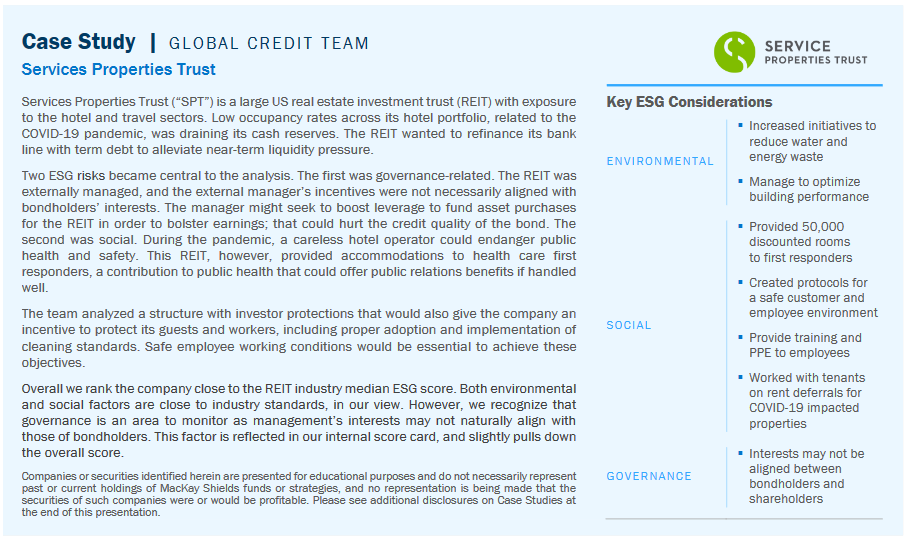

Engagement as a Catalyst

While the market at times provides new sustainable investment opportunities through regulatory reforms or policy initiatives, engagement with brokers and issuers provides the opportunity to actively drive change rather than just wait for issuers to embrace sustainable practices.

Investor engagement with issuers varies widely. At one end of the spectrum are investors that simply wait to receive annual corporate updates. At the other end are shareholder activists that demand representation on the board of directors so they can drive major changes in corporate strategy, and fixed income investors who buy up debt of companies in crisis so they can negotiate the terms of a bankruptcy reorganization.

MacKay Shields takes a mid-spectrum approach: ongoing dialogue with management about ESG and other concerns to influence their business decisions in ways that improve their ESG practices and credit quality, with the goal of engagement leading to narrower spreads.

Make no mistake: ESG engagement meetings are quite different from traditional company meetings with investors, at which company managers “disclose” financial data that is already publicly available. ESG engagement meetings are dialogues, in which investors express ESG concerns and the disclosures needed to track progress and the companies explain their ESG efforts. Not all meetings are productive, but at its best, ESG engagement can be a virtuous circle that helps both investors and companies to better understand the company’s risks and potential rewards.

Investors get the information they need to size up risks and assess whether market prices reflect the risks appropriately, while issuers can learn about emerging threats to their businesses that investors see. The company may also benefit from a lower cost of funding on future issues, if investors see the company effectively managing its risks or building a more durable business.

For particular investments, our engagement process typically starts before the bond is issued and may continue until it is paid off. Typically, we not only meet with company management during investor roadshows for new issues but also interact with the lead underwriters seeking to structure the debt. By expressing interest in being an anchor investor in a new issue, we gain an opportunity to encourage issuers to improve their ESG policies and perhaps include specific disclosures we can use to monitor progress in addressing them. (See Case Study above from the Global Credit team.)

Promoting Transparency

Involvement in the structuring of deals is critical for us to not only encourage sustainable practices but also avoid greenwashing, which has become all too prevalent.

One issuer recently issued a bond with a key performance indicator (KPI) tied to carbon emissions that looked attractive on the surface, until it became clear the issuer already had met the goal. Investment banks often contact us about potential bond issues that would fund older projects previously in operation.

We think green bonds should finance positive change, not give issuers retroactive credit for things they did long ago. While it’s not uncommon for projects to be built with short-term loans that are subsequently refinanced, MacKay Shields and some end investors often prefer to see new issues fund projects, which are started no more than two years prior.

Investors are also pushing back on securities-based lending bonds they believe do not have challenging key performance indicators. Investors want more detailed information on how the proceeds will be used, and what the key performance indicators are really measuring.

Conclusion

We see a wide array of compelling opportunities in the sustainable fixed income realm that can help investors to meet both their ESG goals and their traditional financial goals.

These goals are often, if not always, complementary, since ESG risks can damage or enhance a credit. While we welcome efforts by regulators to make the sustainable investing market more transparent, we are pleased survey participants said they aren’t willing to embrace homogenized approaches that could limit their choices and prevent active managers like us from making the most of their sustainable investing portfolios. Simply relying on ratings and labels, perhaps as in a passive portfolio, may mean giving up on significant risk-adjusted return potential.

Our forward-looking active approach incorporates ESG considerations into financial analyses of bonds and portfolio construction, engages with issuers to influence them to structure bonds to meet ESG goals, and monitors issuers’ progress. That helps us find opportunities other investors might overlook, buy bonds before ESG improvements are widely recognized, and deliver positive

ESG outcomes.

Appendix

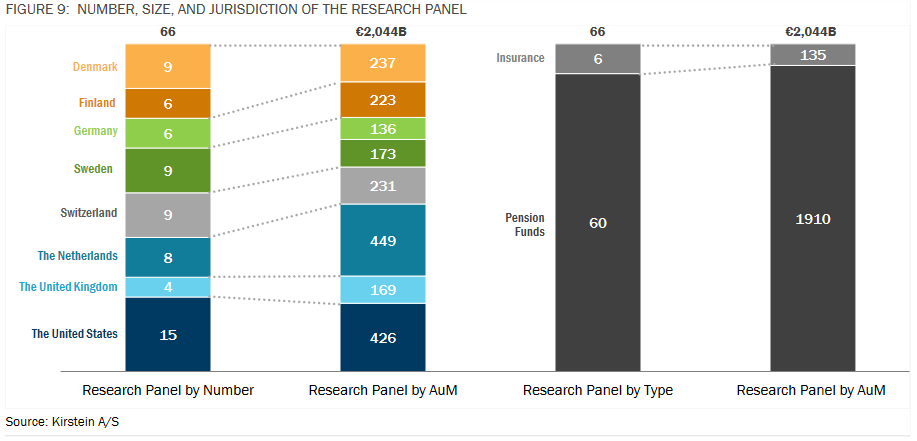

Kirstein A/S prepared this research in collaboration with MacKay Shields, based on interviews and survey responses from 66 pension funds and insurance companies located in Europe and the United States. The research panel manages a combined asset base of EUR 2,044 billion, and was selected to represent a sample of ESG opinion in these two markets.

The European investors from seven countries with a combined €1,818 billion in assets under management comprise 51 of the 66 participants; we feel confident this is a representative sampling of the market. Only 15 US investors with €426 billion in combined assets were willing to participate; they constitute a small share of the vast US market and may be less representative.

To capture the opinion of key decision makers in both Europe and the United States, one-third of the participating investors are Chief Investment Officers or division heads. The rest of the panel is comprised of ESG and fixed income specialists who manage ESG portfolios or select external managers.

In addition to drawing on the research panel’s responses, Kirstein used its extensive experience conducting institutional market research and internally developed frameworks to interpret the results and reach conclusions.

For More Information

CASPER HAMMERICH

Director

Kirstein A/S

MADELEINE FULST

Managing Director

Head of UK & EMEA Distribution

MacKay Shields Europe Investment Management Limited

IMPORTANT DISCLOSURE

Availability of this document and products and services provided by MacKay Shields LLC and/or MacKay Shields Europe Investment Management Limited (together, “MacKay Shields”) may be limited by applicable laws and regulations in certain jurisdictions and this document is provided only for persons to whom this document and the products and services of MacKay Shields may otherwise lawfully be issued or made available. None of the products and services provided by MacKay Shields are offered to any person in any jurisdiction where such offering would be contrary to local law or regulation. It does not constitute investment advice and should not be construed as an offer to buy securities. The contents of this document have not been reviewed by any regulatory authority in any jurisdiction. This material contains the opinions of certain professionals at MacKay Shields and are subject to change without notice. This material is distributed for informational purposes only. Forecasts, estimates, and opinions contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Any forward-looking statements speak only as of the date they are made and MacKay Shields assumes no duty and does not undertake to update forward-looking statements. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of MacKay Shields LLC. ©2021, MacKay Shields LLC. All Rights Reserved.

CASE STUDIES

Case studies provided herein are for informational purposes only. Security selection examples are presented for educational and illustrative purposes only, and are only intended to illustrate the portfolio management team’s ESG investment process and discipline. Illustrations and examples are not intended, nor should they be construed as, recommendations to buy or sell any individual security. There is no assurance investment objectives will be met. Information included should not be considered predicative of future transactions or commitments made by MacKay Shields nor as an indication of current or future profitability.

NOTE TO EUROPEAN INVESTORS

This document is intended for the use of professional and qualifying investors (as defined in the Alternative Investment Fund Manager’s Directive) only. Where applicable, this document has been issued by MacKay Shields Europe Investment Management Limited, Hamilton House, 28 Fitzwilliam Place, Dublin 2 Ireland, which is authorized and regulated by the Central Bank of Ireland.