But there is good news for those who seek to harness the power of the stock market to build long-term wealth and achieve financial independence over time.

Learn five ways that being a dividend growth investor can help you reach your financial goals and make you a better long-term investor. By keeping a steady hand and staying disciplined, investing in dividend growth stocks can provide a stable, growing income stream that can fund your needs, desires, and retirement over time.

1) Dividends are a Major Source of Long-term Market Returns

The first argument for being a dividend growth investor is simply the historical importance of dividends to a portfolio’s total return. Most investors alive today have mostly known a stock market in which share price appreciation was the underlying goal.

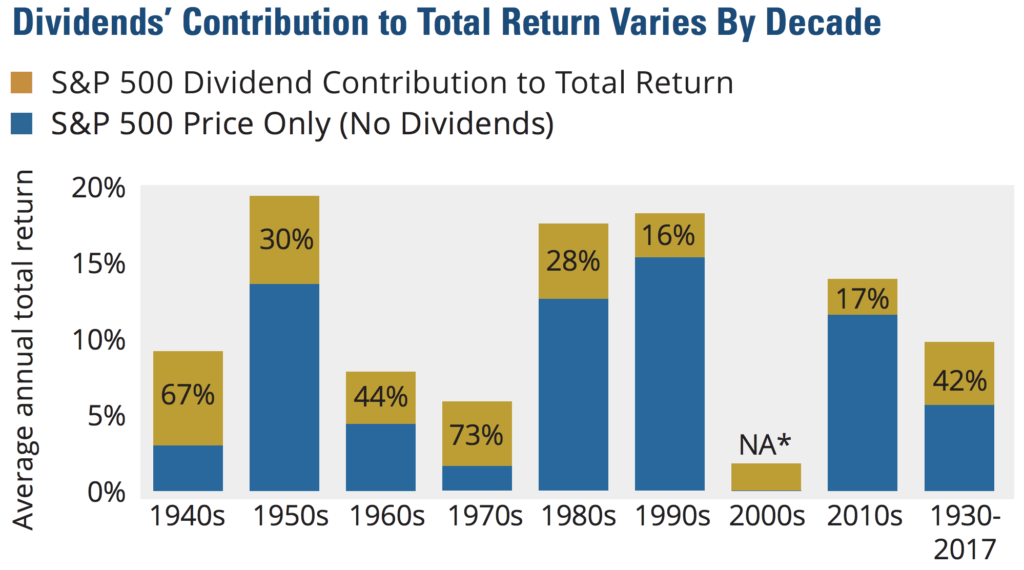

However, from 1930 through 2017 dividends accounted for about 42% of the S&P 500 Index’s total return, according to the Hartford Funds. Dividends are clearly important.

And as you can see in the chart below, at certain times such as the 1970s and 2000s, dividends accounted for well over half of the market’s returns. This can happen when stock prices stagnate or decline over a period of time yet dividend income continues rolling in.

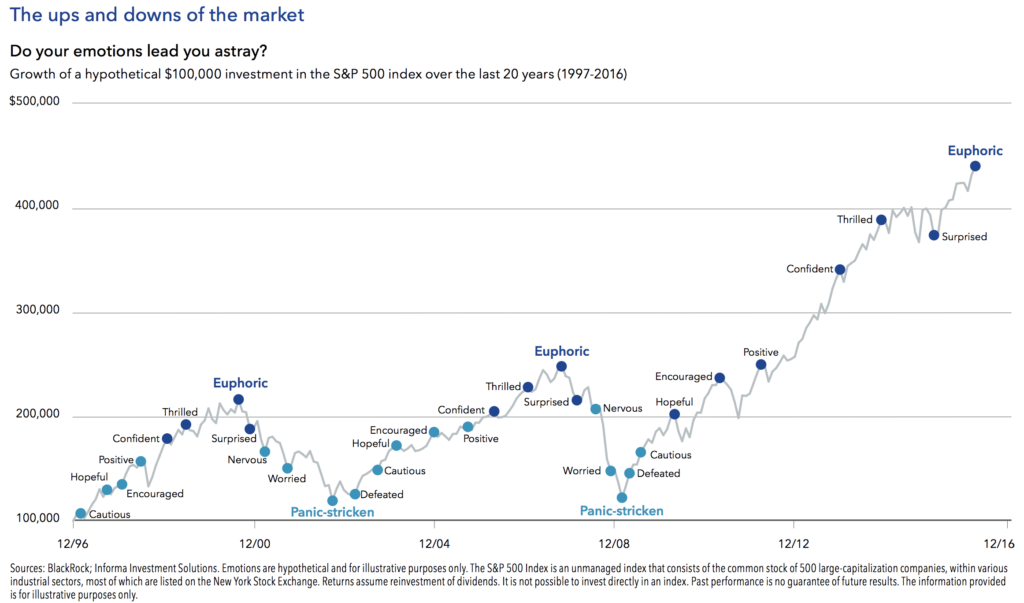

This makes intuitive sense if you think about it like this. If you own a growth stock (i.e. one that doesn’t pay a dividend), then the only way you can earn a return is through share price appreciation. And, as we all know, the market can be gut-wrenchingly volatile.

So say you bought Alphabet (GOOGL), which pays no dividend. Over several years the company grows, and the share price rises with it. But if, right before you need to sell to meet a certain goal, such as funding the down payment on a house or paying for your children’s college education, the market falls off a cliff, such as it did during the early 2000s tech bubble or 2008-2009, then most, if not all, of those capital gains can vanish very quickly.

You could even end up losing 5 to 10 years of unrealized profits in a few months, and if you have to sell? Well, then you gained nothing for all of your patience and saving over that time.

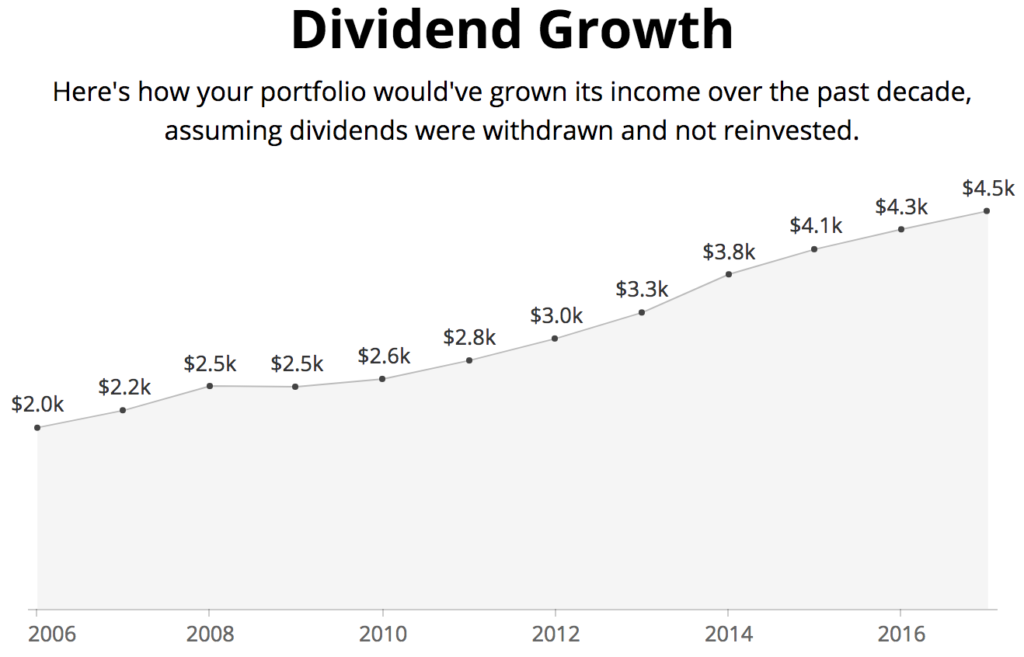

On the other hand, a quality dividend growth stock can provide you with a rising income from your investment, which you can then reinvest into more shares, creating an exponentially growing income stream over time.

In other words, as a dividend growth investor, the dividends that you accrue are tangible and permanent benefits that no crash can undo. And if you reinvest the dividends into quality dividend growth stocks over time, then even if the market crashes you are still better off since your growing dividend income stream can be reinvested at lower, post-crash prices that lock in a higher yield.

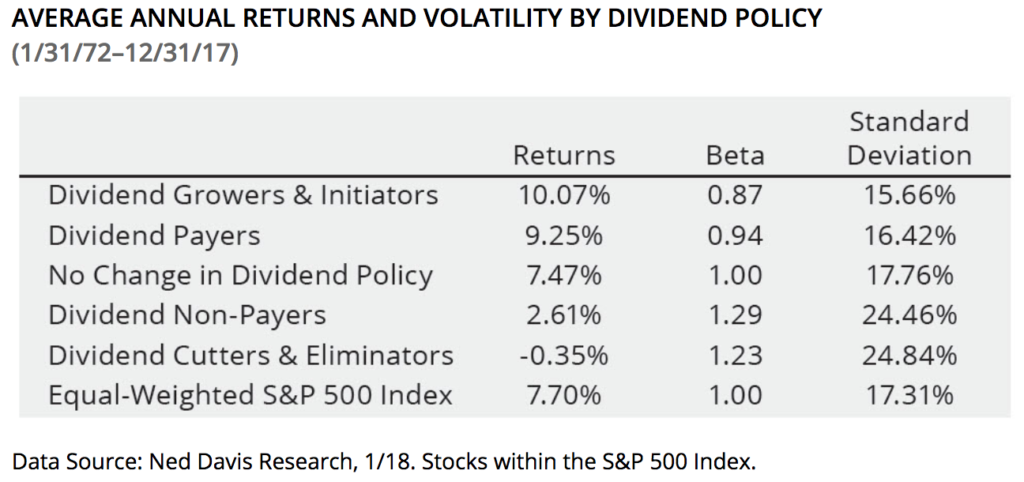

2) Dividend Growth Stocks Have Outperformed the Stock Market over Time

To be fair, however, it is true that this period was marked largely by falling interest rates since the early 1980s. This might have made dividend-paying stocks more attractive.

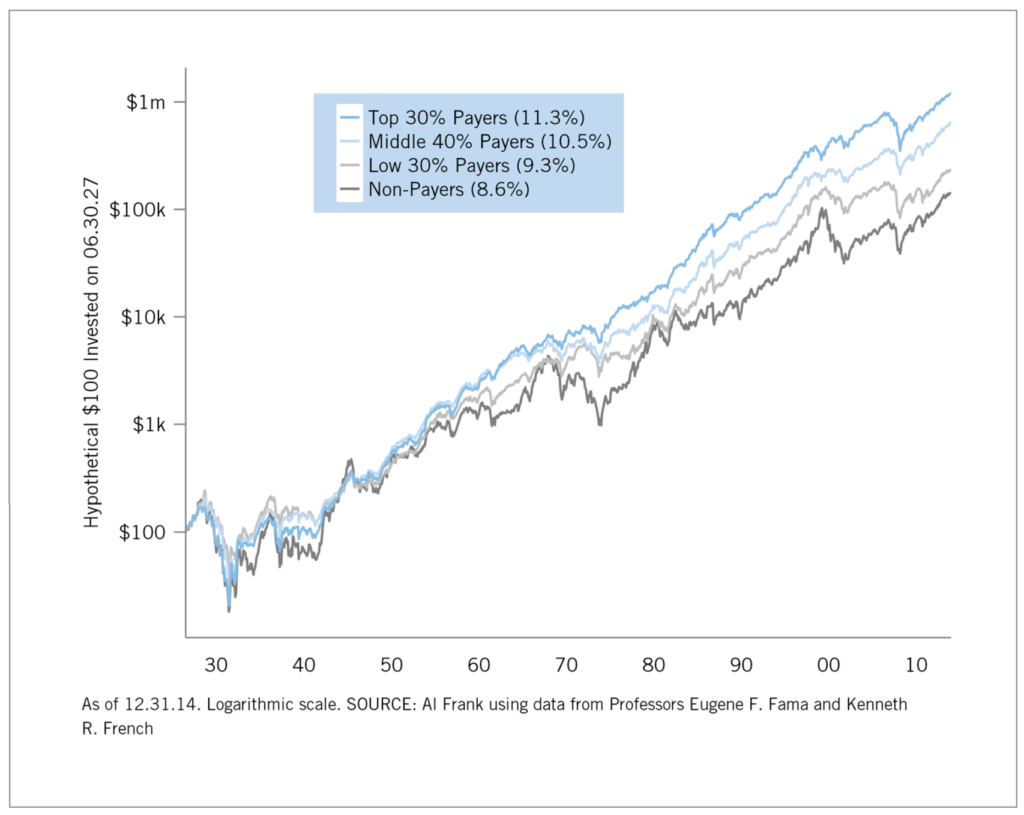

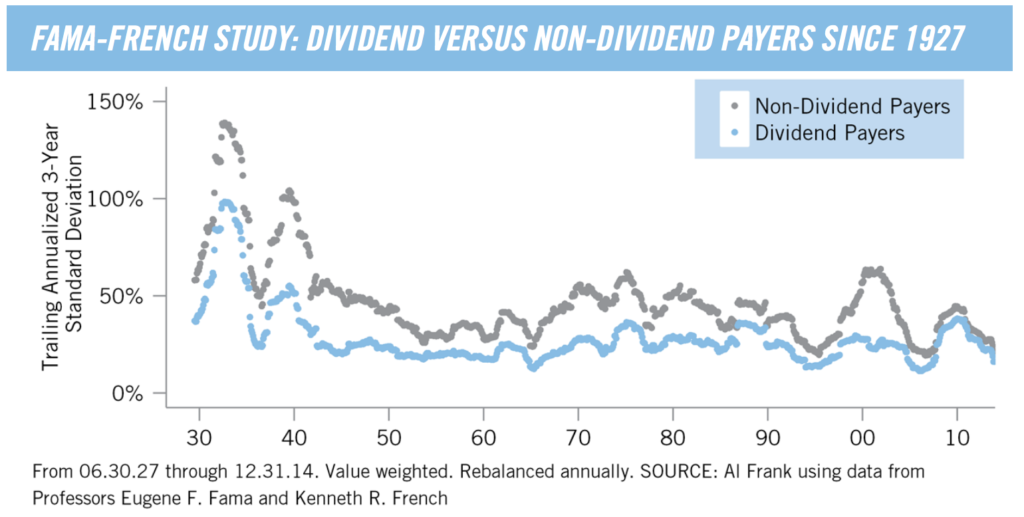

The chart below covers a much longer period of time, from the 1920s through the end of 2014. As you can see, dividend payers went on to meaningfully outperform non-payers.

How is that possible, when theoretically growth stocks are reinvesting all their earnings and cash flow back into their businesses?

The answer lies in long-term focused, conservative management. For example, a company like Facebook (FB), which is growing rapidly while earning a very high margin, may seem like a much better choice than a boring dividend growth stock.

And for a while that may be true. There are certainly many great businesses out there that can create extraordinary wealth for shareholders. Amazon is one example.

However, non-dividend paying stocks focused on growth can also run into a number of unexpected challenges. Sometimes their business models can reach a point of market saturation sooner than expected, or perhaps there is a major shift in technology, consumer preferences, or the competitive landscape.

If the stock was richly valued, reflecting the company’s above-average growth prospects, the occurrence of any of these factors can result in very poor shareholder returns. More importantly, these businesses can struggle to find profitable, needle-moving growth opportunities.

A company can still be generating rivers of profits and cash, but it may have to look broader than the firm’s core business to keep earnings rising. That kind of diversification can be a good thing, but it also poses a big risk because it can result in management making poor capital allocation decisions, such as making splashy acquisitions that it might overpay for and end up writing down later.

It is true that a company is not immune from these risks simply because it pays a dividend. However, there are hundreds of businesses that have managed to pay stable or growing dividends for over 20 years, keeping their payouts intact despite recessions, wars, commodity price shocks, technological shifts, major changes in consumer habits, and more.

These firms have proven to be stable, growing, and cash-rich businesses over time, but management must also be more conservative, both with the company’s balance sheet (how much debt they take on), as well as what growth investments it decides to make.

After all, if you are paying out 50% of profits to dividend-focused investors each year, then you have to be far more selective with what acquisitions or investments you make.

You can’t just throw money around because if you mess up, then you could put the dividend at risk, which could send the share price (stock option, and vested share grants often make up the majority of executive compensation packages) cratering.

Simply put, a commitment to paying dividends places more discipline on management teams to invest in their highest-returning, most promising projects.

3) Dividend Growth Stocks can Help Ensure a Safe Retirement no Matter How Long You Live

However, a 2008 study by Jack Gardner found that, if you were to only stick to the 100 highest-yielding dividend stocks in the S&P 500, the long-term outperformance of this portfolio would actually allow you to increase your annual portfolio withdrawal to 5% and still maintain the portfolio in perpetuity.His findings were so impressive that even Mr. Bengen endorsed his conclusion, that a higher-yielding dividend growth portfolio could indeed allow you a better standard of living during retirement.

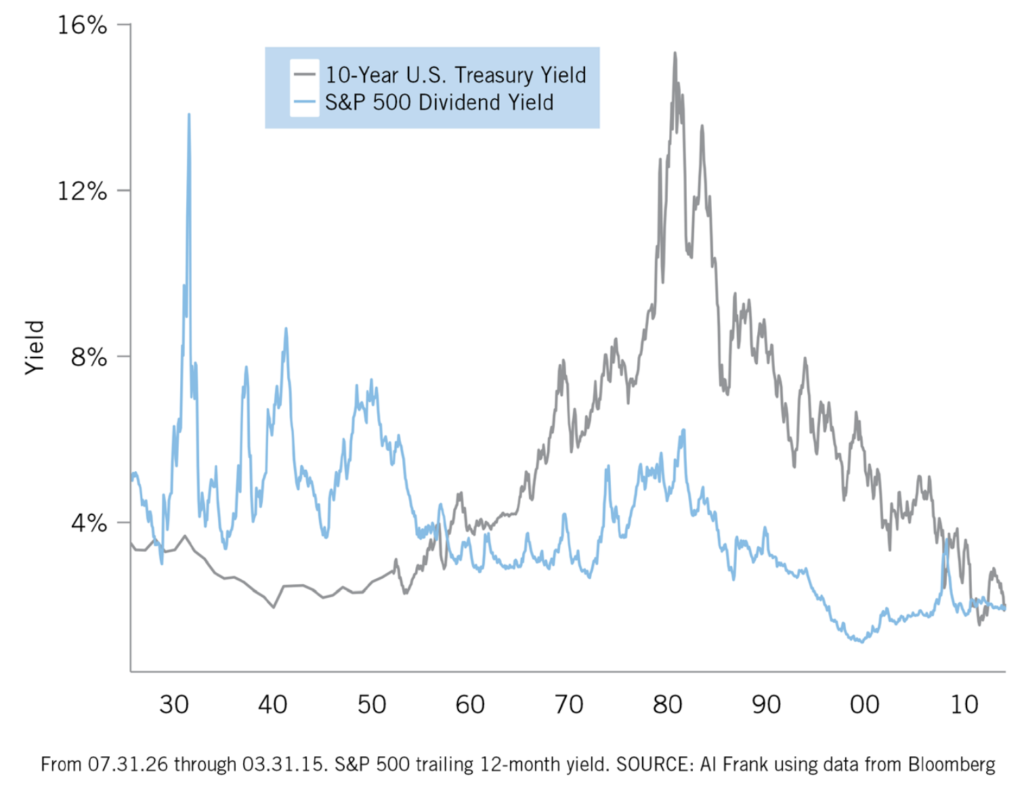

One reason is that bond yields remain near historically low levels, sapping the amount of current income they generate and reducing their long-term returns. Many high dividend stocks offer a higher yield today, will grow their income to protect your purchasing power (bond interest payments are generally fixed), and can appreciate in value over time.

4) Embracing a Dividend Growth Investor’s Mindset can Help You Avoid the Biggest Cause of Market Underperformance

Basically, human nature makes market timing the biggest danger to achieving your long-term investing goals. Sitting in cash in anticipation of the next market correction is often a dangerous and costly game. For one thing, bull market returns are often highly concentrated.

In Ralph Wanger’s book A Zebra in Lion Country, a University of Michigan study that looked at market returns from 1969 to 1993 found that missing out on just the market’s best 90 trading days would have resulted in 20 times worse total returns. Or to put it another way, the market’s top 1% of trading days accounted for 95% of total returns over this 24-year period.

Even more shocking? He referenced another study that found that between 1926 and 1990, missing out on the market’s top 7% performing months would have netted a total return of ZERO over this 64-year period. Which just goes to show that to truly succeed in the market and benefit from the magic of compounding, you need to have your money working for you at all times and for as long as possible.

So how can being a dividend growth investor help? Simply put, you need to think of your portfolio as a business, with a long-term emphasis on maximizing long-term cash flow and value.

Just as Nike (NKE) and Coca-Cola (KO) don’t try to time the global economy by shutting down their businesses during times of economic/market/interest rate uncertainty, the same should apply to your portfolio.

Think of it like this. By focusing on your long-term portfolio income and the growing dividends of your individual companies, you can calm yourself and constantly be reminded what matters in the long term: cash flow.

Did Deere (DE) just disappoint on earnings? So what!? A growing global population means that demand for food, and thus farming equipment, is very likely going to rise over time, and so a temporary downturn in a cyclical industry is not just irrelevant for long-term investors, but potentially a great chance to buy a solid dividend stock on the cheap.

After all, John Deere hasn’t cut its dividend in decades and has in fact grown its payout by more than 9% annually over the last 20 years. In other words, because you are a long-term business owner, concerned primarily with the safety and long-term growth prospects of Deere’s dividend, you aren’t worried about a few bad quarters or a market crash.

The time-tested company has proven itself to be able to reward patient dividend growth investors though numerous business and interest rate cycles, so any correction, bear market, or crash is probably just a chance to buy one of the world’s best farming equipment makers at an even better price and lock in a higher yield on your invested capital.

Which brings us to another important fact, one that dividend growth investing can help you appreciate. No matter what the market is doing, or what kind of lofty valuations it may currently sport, something is always on sale for a prudent dividend growth investor.

Whether it is energy stocks during the oil crash, REITs thanks to rising long-term interest rates, or pharmaceutical stocks during the election, the market is almost always irrationally negative over something.

So if you are worried that buying now at close to record highs is just setting yourself up for a loss, dividend growth investing can give you a long-term, value-oriented, contrarian mindset that can keep you from trying to time the market, and thus set yourself up for far better returns over time.

5) Being a Dividend Growth Investor can Help You Earn a Return No Matter What Stock Prices are Doing

“Owners of stocks, however, too often let the capricious and often irrational behavior of their fellow owners cause them to behave irrationally as well. Because there is so much chatter about markets, the economy, interest rates, price behavior of stocks, etc., some investors believe it is important to listen to pundits – and, worse yet, important to consider acting upon their comments.

Those people who can sit quietly for decades when they own a farm or apartment house too often become frenetic when they are exposed to a stream of stock quotations and accompanying commentators delivering an implied message of “Don’t just sit there, do something.” For these investors, liquidity is transformed from the unqualified benefit it should be to a curse.”

Owning dividend growth stocks helps to separate long-term total returns from the vagaries of the market. Instead of worrying about your portfolio’s price performance any given day or year, just keep an eye on its dividends rolling in. After all, they will account for a substantial portion of your returns.

Even when the S&P 500 Index dropped over 50% during the financial crisis, the stocks we hold in our Conservative Retirees model dividend portfolio in our newsletter would have delivered steady income during this time. Focusing on securing a safe, growing stream of dividends can help you tune out short-term stock price noise and stay focused on what really matters.

As long as a company’s underlying investment thesis remains intact, enabling it to grow its dividend sustainably and securely over time, it is pretty hard to lose in the long term. That is, unless you allow your own emotions to get in the way of a growing income stream by selling for an emotional short-term reason.

Closing Thoughts on Dividend Investing

At the end of the day, building wealth through the stock market is easy to do…in theory. The trouble is that human nature, impatience, unrealistic expectations, and taking advice from the wrong people (with different goals and time frames then you) can result in massive overtrading, high costs, and terrible underperformance over time.

But investing in dividend growth stocks can help you to avoid these pitfalls because these investments can help you to see your portfolio as not just a collection of digital symbols and randomly changing numbers on a computer screen, but real pieces of quality businesses.

In other words, being a dividend growth investor can potentially change your mindset from a short-term trader / speculator / gambler, to a true investor; a business person whose portfolio represents a tangible cut of global corporate profits.