© The Vanguard Group, Inc., used with permission

Paulo Costa, Ph.D.; David Pakula, CFA; Andrew S. Clarke, CFA

- Followers of the F.I.R.E. movement—Financial Independence Retire Early—have long relied on the “4% rule” to determine what they can withdraw from their portfolios over perhaps 40 or 50 years in retirement.

- The 4% rule, however, was originally designed for investors with a 30-year retirement horizon. And the simplifying assumptions it embeds about future returns, diversification, and fees can limit a retirement plan’s viability over both shorter and longer horizons.

- Using Vanguard’s principles for investing success, this research paper illustrates how F.I.R.E. investors can improve their chances of financing an early retirement

In a recent survey by Vanguard Digital Advisor®, 22% of millennials said they planned to retire before age 60.1. The idea of early retirement—embodied by the Financial Independence Retire Early movement—has gone from a niche movement to a more mainstream investment objective, with several books published on the topic.

To achieve early retirement, F.I.R.E. investors cut costs aggressively and save large percentages of their income. Their milestone for financial independence is a portfolio large enough to sustain their spending with inflation- adjusted withdrawals equal to 4% of the portfolio’s initial value—the so-called 4% rule.

The 4% rule can be a good start for retirees, but it most likely needs to be fine-tuned for the F.I.R.E. movement. The rule was conceived for a traditional retiree facing a retirement horizon of 30 years (Bengen, 1994), not for an early retiree who may spend over 50 years in retirement.

This paper aims to help people who are interested in the F.I.R.E. movement understand why the traditional 4% rule could put early retirement at risk and how F.I.R.E. investors can mitigate that risk. We do so in three steps:

- We review the underlying assumptions used to calculate the 4% rule.

- We then show how some of those assumptions can increase the probability of portfolio depletion during retirement.

- Finally, we show how Vanguard’s Principles for Investing Success, combined with a flexible withdrawal strategy, can give early retirees a better chance of financing a long retirement and improve outcomes for those with more conventional retirement horizons.

Notes on risk

All investments are subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. Prices of mid- and small-capitalization stocks often fluctuate more than those of large-company stocks. Investments in bond funds are subject to interest rate, credit, and inflation risk. Investments in stocks or bonds issued by non-U.S. companies are subject to risks including country/regional risk, which is the chance that political upheaval, financial troubles, or natural disasters will adversely affect the value of securities issued by companies in foreign countries or regions; and currency risk, which is the chance that the value of a foreign investment, measured in U.S. dollars, will decrease because of unfavorable changes in currency exchange rates. Diversification does not ensure a profit or protect against a loss. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income.

The 4% rule and its assumptions

Bengen (1994) calculated the maximum percentage that retirees could withdraw annually from their portfolio without running out of money over 30 years. Advisors refer to this percentage as the safe withdrawal rate.

Bengen summarized his findings as follows: “Assuming a minimum requirement of 30 years of portfolio longevity, a first-year withdrawal rate of 4 percent, followed by inflation-adjusted withdrawals in subsequent years, should be safe.” And the 4% rule was born.

However, when calculating the 4% rule, Bengen used simplifying assumptions. These are the ones we evaluate:

- The use of historical returns as a guide for future returns

• A retirement horizon of 30 years

• Returns equal to those of market indexes, without accounting for fees

• A portfolio invested only in domestic assets (“home bias”)

• A fixed percentage withdrawal in real terms (“dollar plus inflation”)

For F.I.R.E. investors, who may be in retirement for 50 years, these simplifying assumptions can create risks. Given the complexities of each retiree’s particular situation, our analysis in this paper abstracts away from incorporating Social Security, health care costs, and taxes, though clearly these significantly affect a retirement plan’s sustainability.

Since Bengen’s 1994 publication, the author has updated his research, suggesting an alternative withdrawal strategy that would allow for flexibility in withdrawing from the portfolio based on market conditions (Bengen, 2001).

More recently, he proposed that a 4.5% withdrawal rate would be feasible if investors added small-capitalization stocks to their portfolio (Bengen, 2006). Despite these updates, the 4% rule remains ubiquitous in financial planning, especially in the F.I.R.E. community.

For this reason, this paper focuses on how the assumptions behind the 4% rule may not be optimal for retirement savers, particularly F.I.R.E. investors.

Example of the 4% rule

Say an investor has retired with a $1 million portfolio. In her first year of retirement, under the 4% rule, she should withdraw 4% of that portfolio, or $40,000 ($1 million x 0.04). For each subsequent year, she should adjust the withdrawal amount for inflation. For example, if in the following year inflation is 2%, she should increase the withdrawal by $800 ($40,000 x 0.02), to $40,800.

Retirement risks

We first examine how the assumptions embedded in the 4% rule could reduce early retirees’ probability of retirement success. We then draw on Vanguard’s Principles for Investment Success and other research to suggest enhancements to the 4% rule that can put F.I.R.E. investors on a better path.

Risk #1: Reliance on historical returns

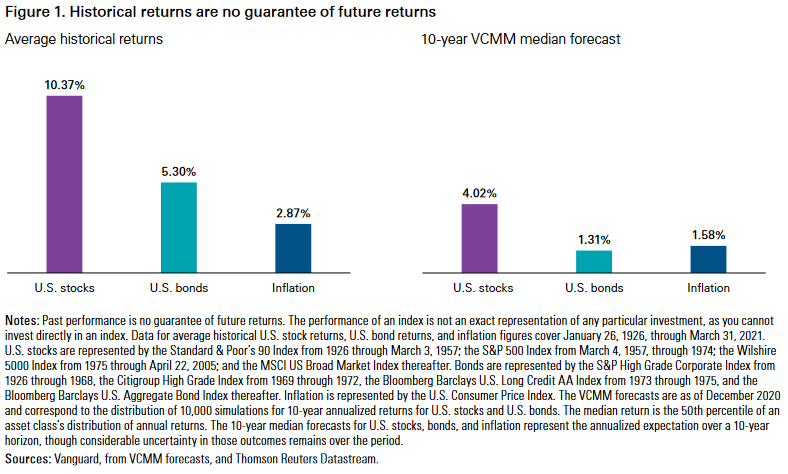

Bengen (1994) assumed that if investors from 1926 to 1992 were able to avoid depleting their portfolio using the 4% rule, this would be a reasonable guide for the future. This assumption relied on the premise that historical returns are good indicators of the returns that investors can expect in the future. This may not be the case, as Figure 1 shows.

Using data covering January 1926 through March 2021, we observe that U.S. stocks had an average annual geometric return of 10.37%, U.S. bonds returned 5.30% on average, and inflation averaged 2.87%. Accounting for inflation, the historical average real returns were 7.50% for U.S. stocks and 2.43% for U.S. bonds.

We use forecasts from the Vanguard Capital Markets Model® to estimate future returns. The VCMM’s 10-year median return forecasts are 4.02% for U.S. stocks and 1.31% for U.S. bonds—both below the historical averages. Its inflation forecast is 1.58%. Accounting for inflation, the 10-year VCMM median forecasts of real returns are 2.44% for U.S. stocks and –0.27% for U.S. bonds.

These forecasts reflect the “initial conditions” (stock market valuations and real interest rate and inflation expectations) that prevailed in December 2020. As the familiar regulatory disclosure notes, “Past performance is no guarantee of future results.” Relying on historical returns to predict future ones may make retirees overly optimistic about their probability of success.

IMPORTANT: The projections and other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from VCMM are derived from 10,000 simulations for each modeled asset class. Simulations as of December 31, 2020. Results from the model may vary with each use and over time. For more information, see the Appendix on the last page.

Risk #2: Retirement horizon of 30 years

The 4% rule was calculated for an investor with a 30-year retirement horizon, not one who retires early.

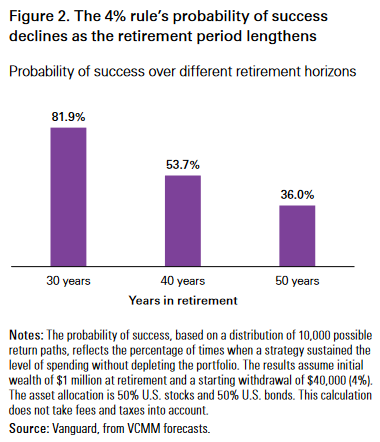

F.I.R.E. investors may be in retirement for up to 50 years. To show the importance of accounting for the proper retirement horizon when determining a sustainable withdrawal rate, we calculate the probability of success for investors facing different retirement horizons (30, 40, or 50 years), using returns forecast by the VCMM.

These calculations assume that investors hold a domestic 50% stock/50% bond portfolio and rebalance it annually. Figure 2 shows the results.

The probability of success of the 4% rule is expected to decline for each retirement horizon beyond 30 years. And the rule may be inadequate for early retirees who may spend 50 years in retirement. With a 4% withdrawal rate, going from a 30-year to a 50-year retirement horizon decreases the probability of success from 81.9% to 36.0%.

The first lesson in Vanguard’s Principles for Investing Success is to develop clear, appropriate investment goals. Therefore, when F.I.R.E. investors calculate their sustainable withdrawal rate, they should consider an appropriate retirement horizon. For the calculations in the rest of this paper, we will consider that horizon to

be 50 years.

Risk #3: Absence of investment fees

Bengen (1994) assumes that investors’ returns are the same as those for the historical market indexes

for stocks and bonds detailed in Ibbotson Associates’

Stocks, Bonds, Bills, and Inflation 1992 Yearbook. But there are costs associated with investing, such as mutual fund expense ratios. One must take these costs into account to determine the probability of success of a portfolio in retirement, as they reduce investors’

net returns.

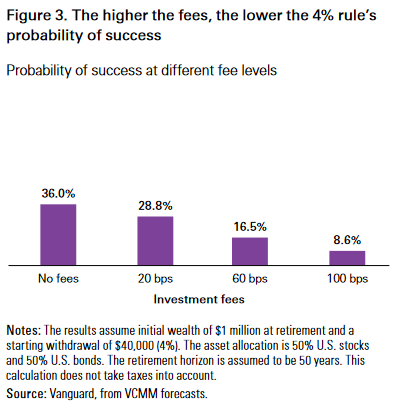

To simulate how investment fees affect the probability of success of the 4% rule, we choose three fee levels—20, 60, or 100 basis points (bps)—in addition to the baselineassumption of no fees. (A basis point is one-hundredth of a percentage point.)

Figure 3 shows that higher fee levels substantially decrease the probability of success for the portfolio of F.I.R.E. investors. For a 4% withdrawal rate, having investment fees of 20 bps gives investors a 28.8% probability of success; with fees of 100 bps, that probability drops to 8.6%.

These numbers offer two lessons from Vanguard’s investing principles. First, costs matter, and taking them into account is important. Second, lower-cost funds help investors keep more of their returns, increasing the probability of success of the portfolio in retirement.

Risk #4: Failure to diversify

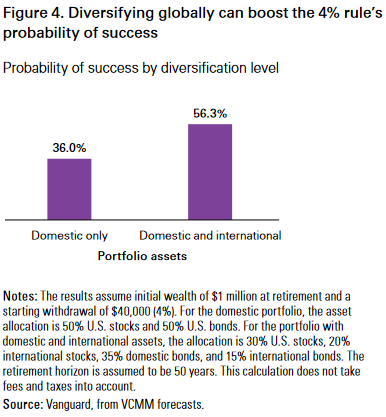

Diversification is a powerful strategy for managing portfolio risk. When calculating the safe withdrawal rates for retirees, however, Bengen (1994) considered only U.S. stock and bond allocations. International stocks and bonds are a source of additional diversification.

Vanguard research has demonstrated that global diversification can reduce a portfolio’s volatility (Donaldson et al., 2021).

And Vanguard’s most recent 10-year capital market forecasts indicate that international

stocks are likely—though by no means guaranteed—to outperform U.S. stocks (DiCiurcio et al., 2020).

For these reasons, we consider the effect of adding international stocks and bonds to investors’ portfolios. Figure 4 shows how international diversification increases the probability of success of the 4% rule for F.I.R.E. investors. When relying on a domestic-only portfolio, investors have a 36.0% probability of success; when they include international stocks and bonds, that probability increases to 56.3%.

It has been said that “diversification is the only free lunch in investing.”

As Figure 4 shows, investors should consider international diversification.

Risk #5: Fixed percentage withdrawal in real terms (dollar plus inflation)

The 4% rule was designed to allow retirees to maintain a constant standard of living. That’s why the 4% withdrawal rate is adjusted yearly for inflation.

For this reason, this type of withdrawal strategy is also known as “dollar plus inflation.” In other words, the withdrawal amount is constant in real terms.

When considering the chances of portfolio depletion, however, the 4% rule may not be efficient given the volatility of financial markets (Scott, Sharpe, and Watson, 2009).

For example, if the market falls substantially in a given period, the 4% rule would advise boosting spending each year to account for inflation. This can substantially increase the risk of portfolio depletion in retirement.

For an investor facing this situation, it is likely best to cut back on spending temporarily.

On the other hand, if the market goes up substantially, annual spending will not increase after accounting for inflation under the 4% rule, even if investors would like to enjoy a higher standard of living given the good market performance.

Although investors may wish to avoid highly variable standards of living from year to year, some flexibility in spending can increase the probability of success of the portfolio in retirement. When evaluating different spending rules, understanding the trade-offs is important.

By being more flexible about spending, investors will forgo some income stability to increase the probability of not depleting their portfolio.

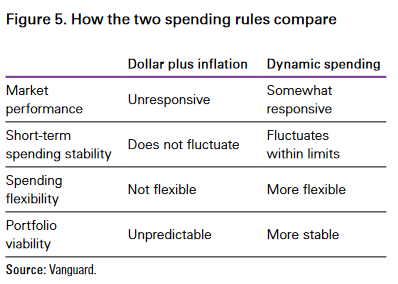

Figure 5 compares the characteristics of a dollar plus inflation rule, such as the 4% rule, and a dynamic spending rule, a strategy that adjusts spending based on market conditions.

To try to reconcile the benefits of income stability from the dollar plus inflation rule and the benefits of increasing the probability of success from dynamic spending rules, Jaconetti et al. (2020) proposed a limit to how much spending can vary each year in a portfolio.

What follows is an example of how the dynamic spending rule adjusts spending in response to market fluctuations.

Example of a dynamic spending rule

Vanguard researchers have created a dynamic spending rule that allows investors to spend more when markets perform well and that reduces spending amounts when markets perform poorly.

Allowing for dynamic spending improves the chances that the portfolio will survive retirement.

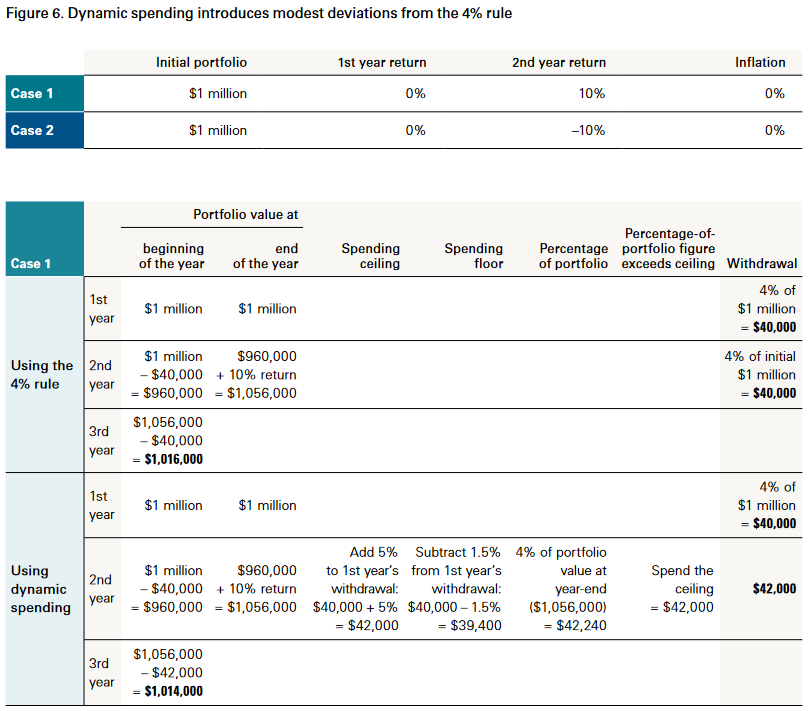

This dynamic spending rule, described in Jaconetti et al. (2020), establishes a spending ceiling of 5% and a spending floor of –1.5%. In the example that follows in

Figure 6, we present two scenarios. In both cases, initial wealth is $1 million, and the first-year market return is 0%. In the first case, the second-year market return is 10%. In the second case, the second-year market return is –10%.

For simplicity, we assume that inflation in both years is 0%. A withdrawal for spending happens at year-end, so the first withdrawal takes place 12 months into retirement.

Regardless of market performance, the 4% rule allows investors with an initial $1 million portfolio to withdraw $40,000 annually, assuming no inflation. On the other hand, in good market scenarios, the dynamic spending rule can allow investors to withdraw more money than the 4% rule does. And when the market goes down substantially, the dynamic spending rule cuts back spending, so that investors benefit more when the market rebounds.

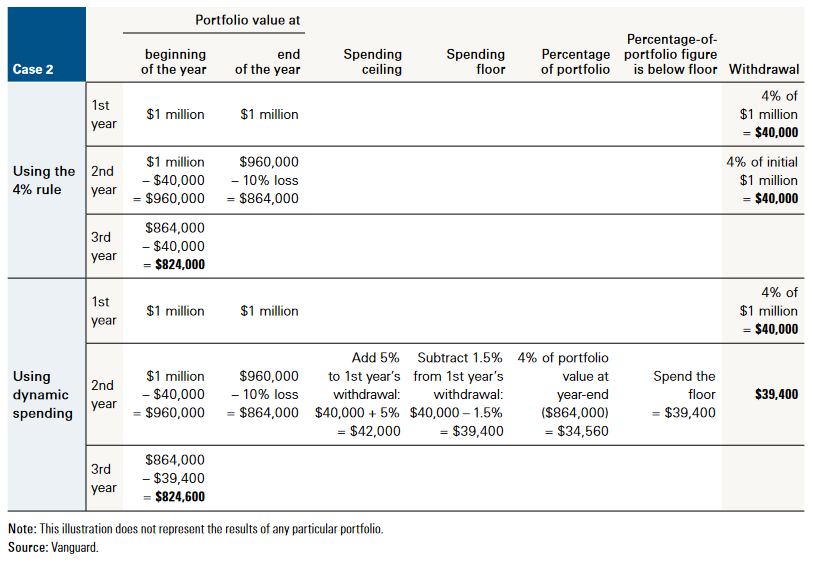

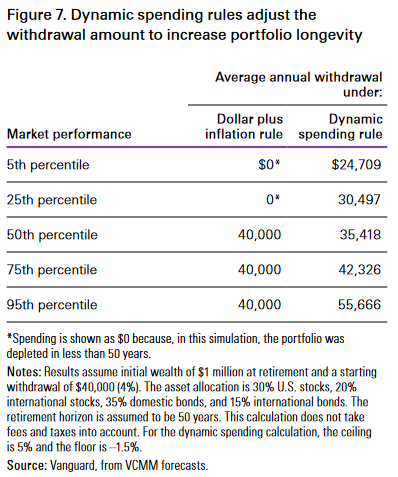

Withdrawal amounts vary between the two rules. Figure 7 shows the distribution of average annual spending for each rule according to the market performances forecast by the VCMM. For simplicity, we assume here that inflation is 0%.

Figure 7 shows that when the markets perform well, investors can adjust their spending upward and improve their standard of living. But when markets perform poorly, the dynamic spending retiree cuts back on spending to reduce the chances of portfolio depletion.

Note that at the 5th percentile of market performance, the dynamic spending retiree would have to cut spending to an average of $24,709, while the dollar plus inflation retiree would risk depleting their retirement portfolio assets completely.

Now we turn back to evaluating how the dynamic spending rule can increase the probability of success of F.I.R.E. investors compared with the standard 4% rule.

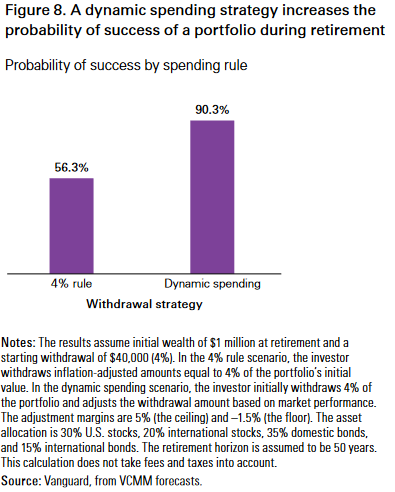

Figure 8 shows that by adopting the dynamic spending rule, investors can increase their probability of success to 90.3%, from 56.3% under the 4% rule.

Applying Vanguard’s research to improve upon the 4% rule

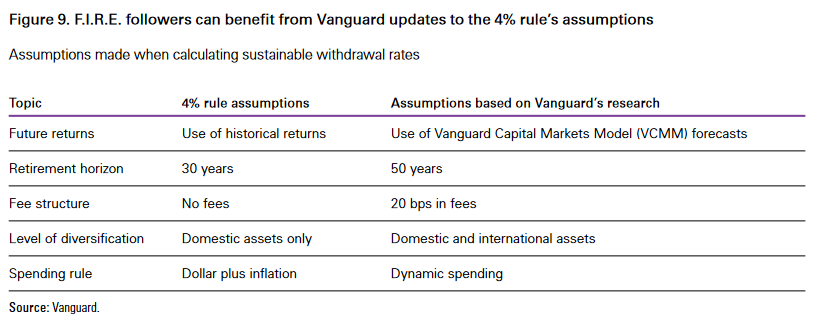

In the previous section, we examined five assumptions embedded in the 4% rule and how, using Vanguard’s research, we could provide more realistic assumptions when calculating sustainable withdrawal rates. Figure 9 summarizes the differences.

By following the simplifying assumptions about the 4% rule in Bengen (1994), F.I.R.E. investors can fall short of their goals. Using Vanguard’s Principles of Investing Success and related research, we evaluate how F.I.R.E. investors can improve their chances of success in the following ways:

- Develop appropriate goals: Change the retirement horizon to 50 years.

- Minimize costs: Assume some costs (despite their absence from the 4% rule) but keep them low.

- Diversify globally: Broaden the portfolio from domestic assets to both domestic and international assets.

- Adjust the spending rule: Shift from dollar plus inflation to dynamic spending.

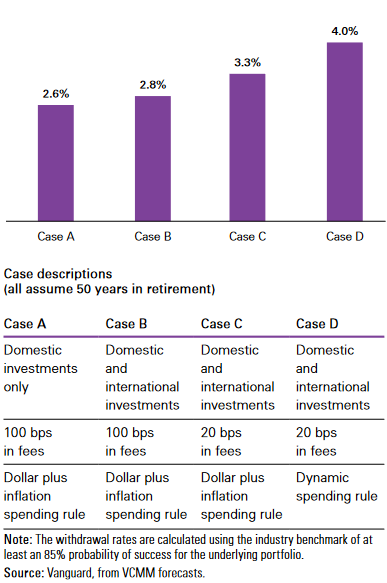

To show how important each of these assumptions is to improving the withdrawal rate for F.I.R.E. investors, we calculate that rate from the worst-case to the best-case scenario (Figure 10). The calculation assumes a 50% stocks/50% bonds allocation throughout. The returns are estimated using the VCMM and a retirement horizon of 50 years.

We compare four cases that we’ve labeled A through D.Case A—which assumes domestic investments only, 50 years in retirement, 100 bps in fees, and use of the dollar plus inflation spending rule—is our worst-case scenario. Case B improves on it by adding international assets; Case C improves on Case B by reducing fees from 100 bps to 20 bps; and Case D improves on Case C by using dynamic spending instead of dollar

plus inflation.

In Case A, the portfolio can sustain an initial withdrawal rate of 2.6% over 50 years—more than a full percentage point short of the 4% rule. By using Vanguard’s research, however, the withdrawal rate goes up dramatically across the cases. By adding international diversification to the portfolio, the withdrawal rate can increase from 2.6% to 2.8%.

By reducing fees from 100 bps to 20 bps, the rate can rise further to 3.3%. Finally, by using a dynamic spending rule, the rate can rise to 4.0%. In short, by following the steps laid out in Vanguard’s Principles for Investing Success, investors can potentially increase their withdrawal rate.

Conclusion

The 4% rule was created as a guiding principle for retirees to know how much to withdraw in hopes of sustaining their portfolios in retirement. The F.I.R.E. movement uses the 4% rule as a guiding principle for how much money to save, when to retire, and how much to spend in retirement.

But the 4% rule was calculated for investors with a retirement horizon of

30 years, whereas F.I.R.E. investors can stay in retirement for 50 years.

We reviewed the assumptions used in calculating the 4% rule and laid out more realistic scenarios for F.I.R.E. investors. We found that F.I.R.E. investors may fall short of their retirement goals if they follow the assumptions made in the 4% rule—namely 30 years in retirement, the use of historical returns as a guide for future returns, domestic-only assets, the absence of investment fees, and a dollar plus inflation withdrawal strategy.

However, if F.I.R.E. investors follow Vanguard’s Principles for Investing Success and related research, they should create appropriate goals, diversify their portfolio allocation to include international assets, minimize their costs, and use a dynamic spending rule.

Using those principles and research, we showed that F.I.R.E. investors are likely to improve both their portfolio longevity and their standard of living in retirement.

==

References

Bengen, William P., 1994. Determining Withdrawal Rates Using

Historical Data. Journal of Financial Planning 7(4): 171–180.

Bengen, William P., 2001. Conserving Client Portfolios

During Retirement, Part IV. Journal of Financial Planning

14(5): 110–119.

Bengen, William P., 2006. Conserving Client Portfolios During

Retirement. FPA Press.

Collins, JL, 2016. The Simple Path to Wealth: Your Road Map

to Financial Independence and a Rich, Free Life. Self-published.

Cooley, Philip L., Carl M. Hubbard, and Daniel T. Walz, 1998.

Retirement Savings: Choosing a Withdrawal Rate That Is

Sustainable. AAII Journal 20(2): 16–21.

DiCiurcio, Kevin, Ian Kresnak, Kelly Farley, and Luigi Charles,

2020. A Tale of Two Decades for U.S. and Non-U.S. Equity:

Past Is Rarely Prologue. Valley Forge, Pa.: The Vanguard Group.

Donaldson, Scott J., Harshdeep Ahluwalia, Giulio Renzi-Ricci,

Victor Zhu, and Alexander Aleksandrovich, 2021. Global Equity

Investing: The Benefits of Diversification and Sizing Your

Allocation. Valley Forge, Pa.: The Vanguard Group.

Jaconetti, Colleen M., Michael A. DiJoseph, Francis M. Kinniry

Jr., David Pakula, and Hank Lobel, 2020. From Assets to

Income: A Goal-Based Approach to Retirement Spending.

Valley Forge, Pa.: The Vanguard Group.

Robin, Vicki, and Joe Dominguez. 2018. Your Money or Your

Life: 9 Steps to Transforming Your Relationship With Money

and Achieving Financial Independence. New York, N.Y.:

Penguin Books.

Scott, Jason S., William F. Sharpe, and John G. Watson, 2009.

The 4% Rule—At What Price? Journal of Investment

Management 7(3): 31–48.

Vanguard, 2020a. Generational Views on Financial Advice,

Investing, and Retirement: A Vanguard Digital Advisor™ survey.

Valley Forge, Pa.: The Vanguard Group.

Vanguard, 2020b. Vanguard’s Principles for Investing Success.

Valley Forge, Pa.: The Vanguard Group.

==

Appendix. About the Vanguard Capital

Markets Model

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model is a proprietary financial simulation tool developed and maintained by Vanguard’s Investment Strategy Group. The model forecasts distributions of future returns for a wide array of broad asset classes.

Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate bond markets, international bond markets, U.S. money markets, commodities, and certain alternative investment strategies. The asset return distributions shown in this paper are drawn from 10,000 VCMM simulations based on market data and other information available as of December 31, 2020.

The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta).

At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly

financial and economic data. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time.

The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

Indexes for VCMM simulations

The long-term returns of our hypothetical portfolios are based on data for the appropriate market indexes through December 31, 2020. We chose these benchmarks to provide the most complete history possible, and we apportioned the global allocations to align with Vanguard’s guidance in constructing diversified portfolios. Asset classes and their representative forecast indexes are as follows:

- U.S. stocks: MSCI US Broad Market Index.

• U.S. bonds: Bloomberg Barclays U.S. Aggregate Bond Index.

• Global ex-U.S. (international) stocks: MSCI All Country World ex USA Index.

• Global ex-U.S. (international) bonds: Bloomberg Barclays Global Aggregate ex-USD Index.

==

Fuel for the F.I.R.E.: Updating the 4% rule for early retirees

https://personal.vanguard.com/pdf/ISGFIRE.pdf

https://investornews.vanguard/fueling-the-fire-movement-updating-the-4-rule-for-early-retirees/