Written by: Adam Shenton

Original Source: Mercer.com

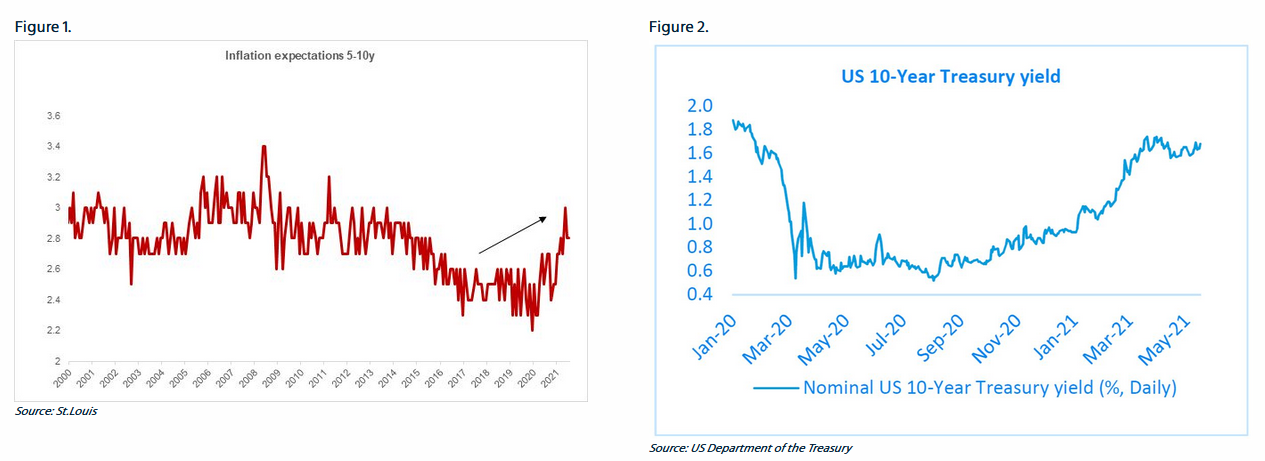

As the world recovers from the coronavirus pandemic, improved economic prospects are bringing back long-dormant inflation into focus. The big talking point across markets at the moment hovers around whether the recent spike in inflation is transitory or the start of a new (higher) inflationary regime – and if the latter, what protective action investors should take.

Earlier this year, we published a series of research pieces considering the potential inflationary outcomes and alerting investors to the need to watch for inflationary surprises. We argued that investors should consider inflation sensitive assets, such as real assets, REITs, infrastructure equities, but now we turn to the defensive, fixed income part of the portfolio. Afterall, isn’t inflation the spectre of fixed income assets?

Seek to reduce interest rate sensitivity through short duration strategies

Reducing the sensitivity of your portfolio to rising interest rates through a short duration strategy can be a relatively simple way to help mitigate volatility and losses as interest rates rise. Short duration strategies seek to deliver excess returns either through a focus on short-dated corporate credit or via a broader set of return drivers, such as rates, spreads and currencies. A market where inflation picks-up from low levels is typically symptomatic of the economy doing well, which is a good environment for corporate credit spreads, as defaults are likely to remain subdued.

Enhanced flexibility – Absolute Return Fixed Income (“ARFI”)

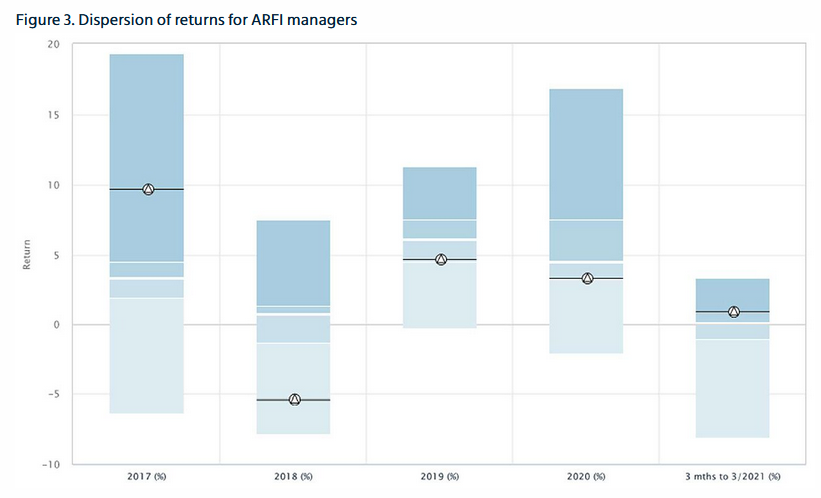

ARFI strategies provide investors with access to a broad global opportunity set of alpha sources. When combined with flexible investment techniques (e.g., hedging), they are expected to show a low correlation with the overall direction of interest rates and credit spreads, with a greater focus on alpha to help deliver returns. ARFI strategies are generally highly liquid but the breadth and flexibility of mandates means we see differentiated investment approaches and meaningful dispersions in outcomes between managers. Therefore, investors should consider adopting a multi-manager approach to implementation.

Returns in U$ (before fees) over last 5 calendar years ending March -21. Comparison with the international fixed – absolute return universe (actual ranking)

Blue boxes = the range of returns in the universe. Solid white lines = the return of the median manager. Smaller white lines = the return of the upper and lower quartile manager respectively

LIBID1MUK (London interbank bid rate, cash benchmark 1 month GBP)

Source: MercerInsight MPA, March 2021

Tilt towards floating rate assets

Shifting part of a portfolio to assets that provide coupons linked to a risk-free rate helps reduce interest sensitivity without necessarily compromising return expectations. Loans and securitised assets, such as mortgage-backed securities, are good examples of this. Meaningful floating rate exposure can be found in ARFI, multi-asset credit and securitized credit strategies. However, investors need to properly understand the different risks they are taking by investing in these assets, which are often less liquid and more complex than traditional fixed income securities, and helps ensure exposures are appropriately diversified.

Mercer’s Investment Solutions team is ready to help you prepare your portfolio for any economic scenario, allowing you to see through short-term noise and focus on your longer-term financial goals.

For further information, please visit our website or contact our investment solutions team.